- DATE:

- AUTHOR:

- The Narmi Team

Daily Workflows Done Right

Narmi’s admin platform is designed to make your staff members' day-to-day workflows easier. We are constantly investing in our products to work towards our goal of helping to bring efficiencies to the back-office. Continuous enhancements to daily workflows can have a big impact – though the time and effort saved may seem to make little difference on any given day, the impact it delivers over months and years can be enormous. With that in mind, this month, we have made improvements to our digital account opening admin platform that elevate your team's daily workflows and in turn, enhance the customer experience.

What workflow enhancements within the admin platform did we make?

1. Save time through increased application visibility.

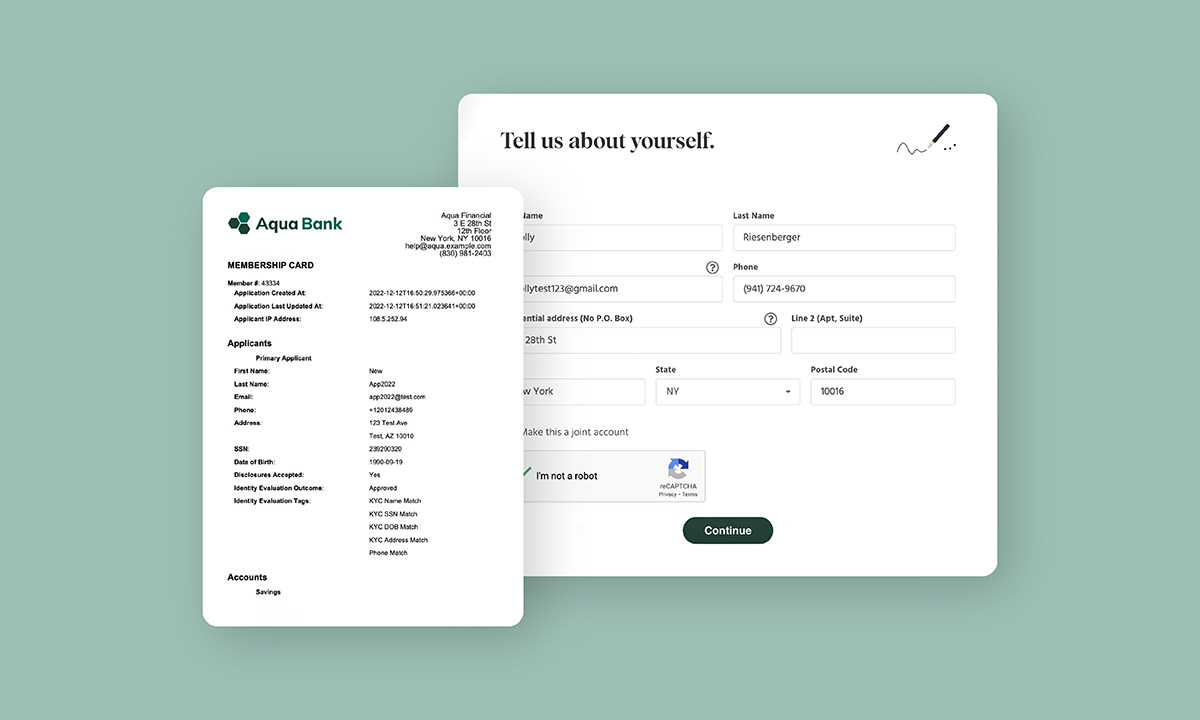

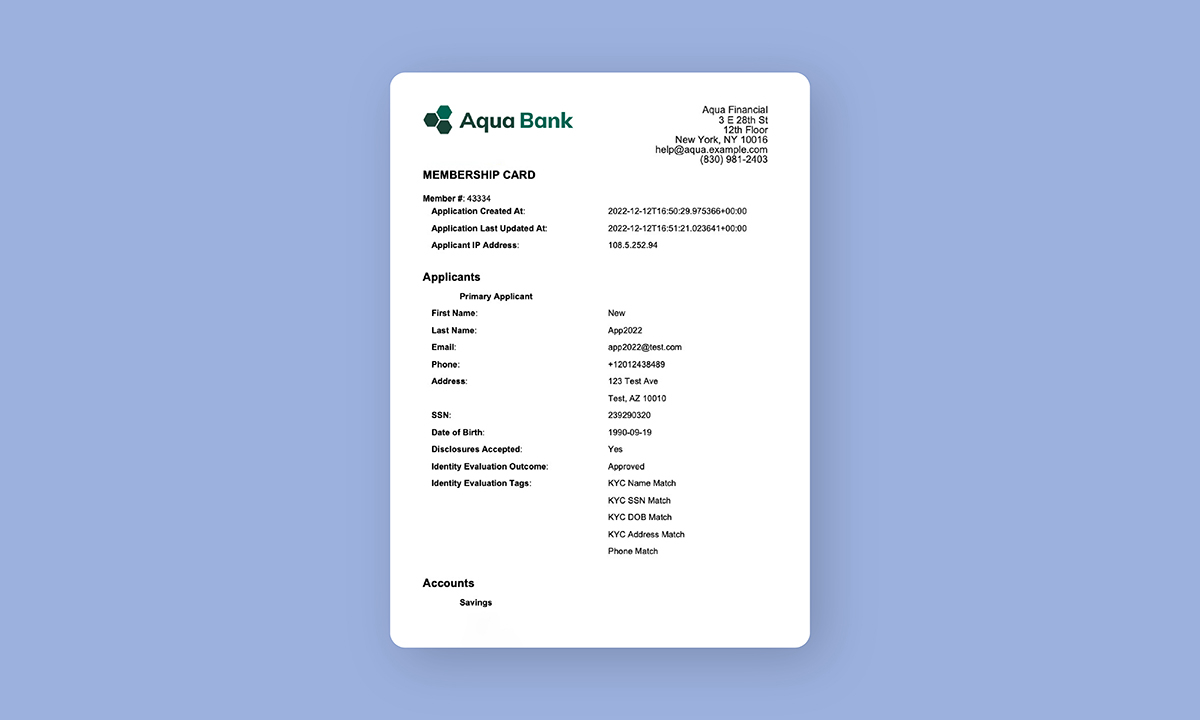

Within the admin platform, we’ve updated the membership card to show increased detail on each application. As a staff member, you’ll now see the application creation time, last application update, the application IP address, and the most recent Alloy tags from the latest evaluation. This gives a fuller picture of each applicant to staff and quickens any manual decisioning time.

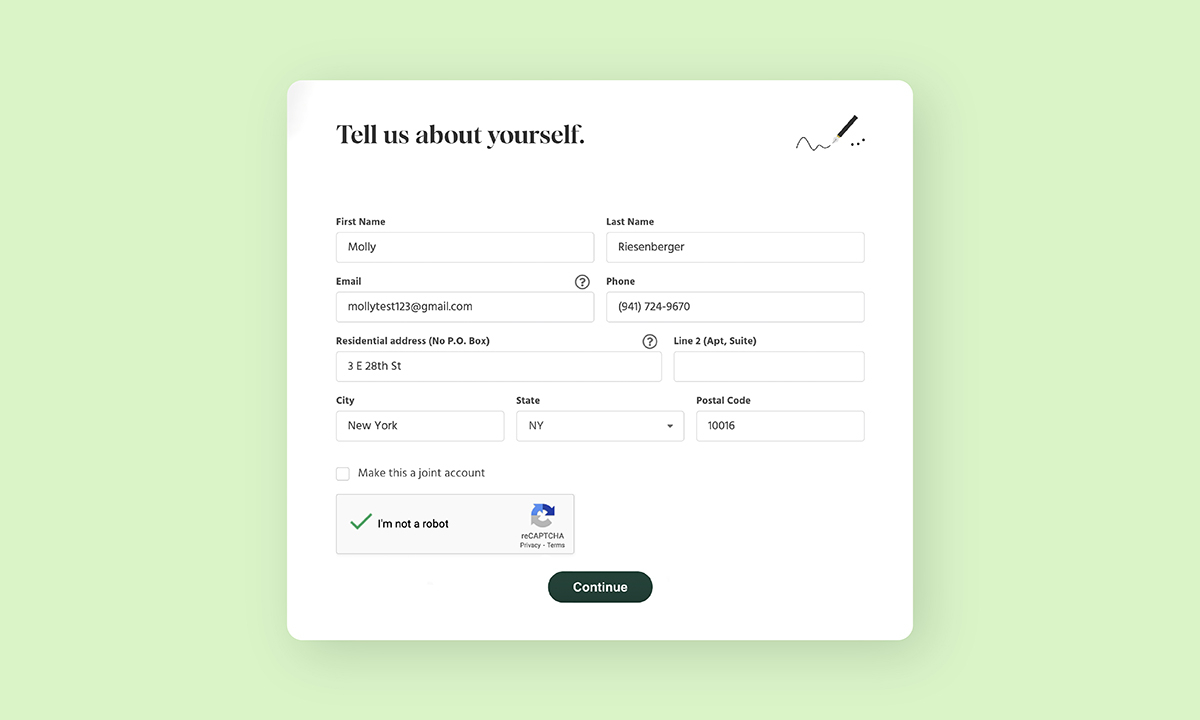

2. Cut down fraud through the addition of CAPTCHA.

We’ve added in a setting to turn on CAPTCHA for Digital Account Opening to give financial institutions the option for added security. CAPTCHA is a security measure that requires users to complete a simple test to prove they are human, which works to stop bots from sending in repeated false responses and helps better secure the account.

The CAPTCHA system uses Google’s algorithm. Depending on the likelihood that the user is a bot, the system will prompt the user to complete one of the following actions:

Click a singular check box that confirms that the user is not a robot

Type in a series of letters and numbers into a blank box

Check a number of images that correspond to a word prompt

Once the user is able to accurately solve the puzzle variation, they will be confirmed as a human and able to complete the rest of the application. The impact of this ultimately decreases the burden of fraudulent applications on your staff – saving them time, and saving your financial institution money.

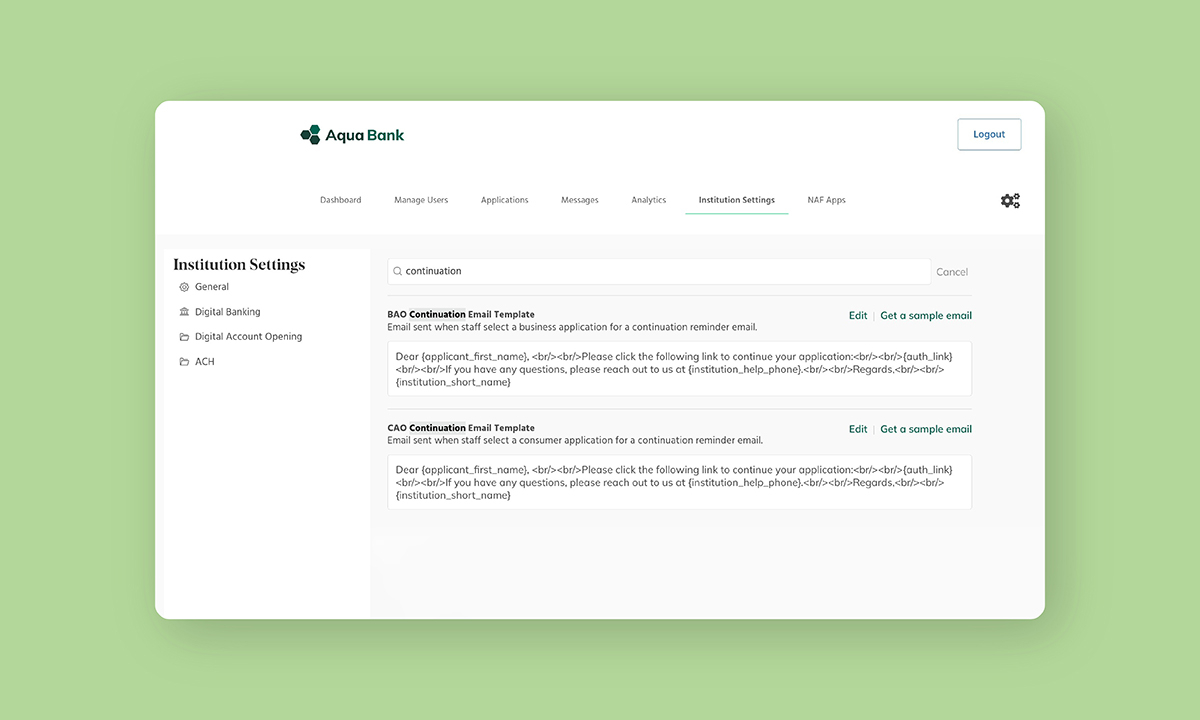

3. Introduced continuation email templates for Business Account Opening.

As part of our ongoing improvements to Business Account Opening, we’ve introduced email templates that allow financial institutions to customize the messaging for potential Business Account openers. This works in parallel to the continuation email template we have enabled for consumer account opening and gives staff more control over the continuation reminder email.

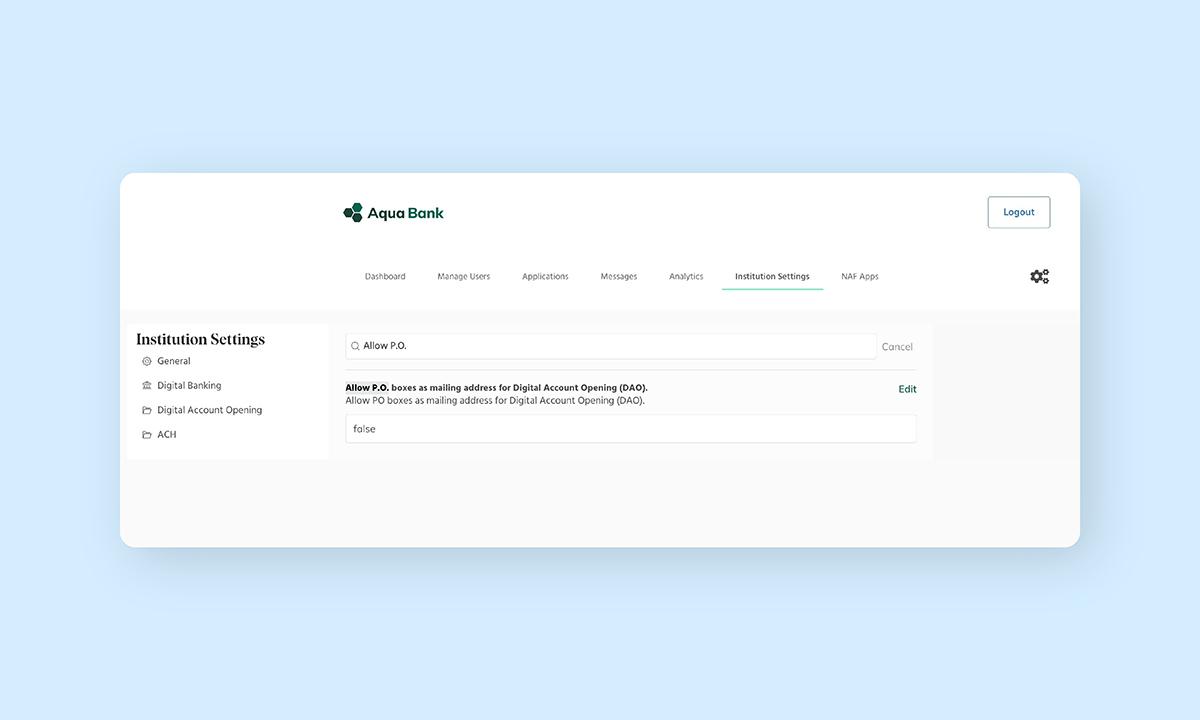

4. Quick resolution times by allowing PO boxes as mailing addresses.

We’ve added the option for staff to allow users to include a PO box as a listed mailing address during the Account Opening flow. By giving staff the ability to turn this functionality on, it works to preemptively alleviate user requests and give staff a speedy solution to any user who needs to use a PO box as their primary mailing address.