- DATE:

- AUTHOR:

- The Narmi Team

Delegate Efficiently through Manage Users Updates

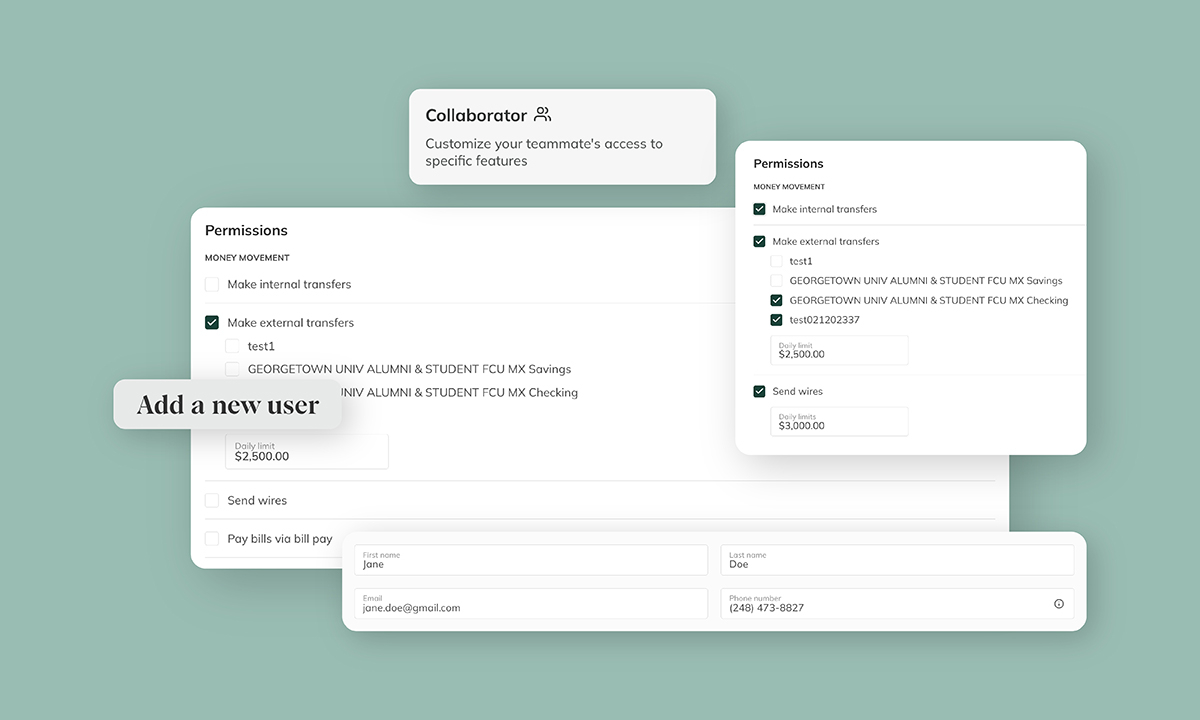

At Narmi, we're committed to continuously improving our business banking suite to provide a more intuitive and efficient user experience. We're proud to announce the latest redesign of our Manage Users tool, focusing on elevating functionality and offering user-friendly permissioning logic.

Here's what users can expect in the updated Manage Users tool.

Users will experience a streamlined, simplified dashboard

Users will experience a streamlined, simplified dashboard

When admin users are setting permissions for collaborators, they’ll notice that the 'external accounts' section is now situated within the general 'permissions' area, making the process of assigning permissions for external transfers more intuitive and cohesive. This is standard across web and mobile, making it easier than ever for business banking admins to set and edit permissions as soon as they need to, whether they’re at their desk or on the go.

We’ve added new disclosures and error messaging for guided limit setting

We’ve added new disclosures and error messaging for guided limit setting

To improve guidance for users when setting wire and ACH transaction limits, we've added updated disclosure pop-ups. These pop-ups outline both the organizational limits and the individual limits held by each member for wire and ACH transactions. We've also updated the error messaging logic, alerting admin users if they attempt to set individual limits that exceed the organizational limit, or if the admin attempts to grant permissions without setting a limit, guiding them through the process and informing them of permissible transfer actions based on their specific organization limits.

The backend logic for limits has been improved to give business banking users more peace of mind.

The backend logic for limits has been improved to give business banking users more peace of mind.

On the backend, we re-designed the way organization and individual limits are set. Now, all users assigned to an organization can retain their individual limits, but these limits can never exceed the top-line organizational limits. This approach grants admin users the flexibility to align permissions with individual role requirements for external wire or ACH transfers, while ensuring transactions maintain the organization's financial integrity. This strikes a balance between individual autonomy and safeguarding the business’s financial boundaries.