- DATE:

- AUTHOR:

- The Narmi Team

Optimize Your Deposit Strategy with Narmi’s Updated AO Funding Solution

When funding new accounts, it's crucial to strike a balance between pursuing growth and managing risk. We at Narmi recognize the importance of giving Financial Institutions as much transparency and control over every transaction so you can make well-informed decisions about which deposits you want to approve. That's why we are excited to share a series of enhancements we've made to the AO Funding process, including a new AO ACH Manager and a native NACHA solution, both of which aim to streamline account funding activities, enhance compliance measures, and improve the overall user experience for staff members.

Here's what to expect in our updated AO Funding experience:

A New Native NACHA File Generation Solution

A New Native NACHA File Generation Solution

In our continuous effort to provide our FI’s more control over deposits entering their institutions, we’ve built a native NACHA solution that directly collects funding requests within the Narmi platform, and sends them as NACHA files for your FI to submit through your existing ACH processing flow. We’ve completely eliminated the reliance on third-party processors for AO ACH funding, simplifying the funding process while also enhancing the predictability and efficiency necessary to support your growth objectives. Financial institutions can coordinate their marketing efforts with the funding limits that meet their risk appetite, by setting the funding limit per application directly in the admin platform, providing a flexible and easy-to-manage experience for staff.

Robust Transaction Verification for Enhanced Security

Robust Transaction Verification for Enhanced Security

To make sure that your financial institution is set up to scale in a way that is both secure and compliant, we've partnered with a top-tier provider of instant account verification and validation service, ensuring that every manual transaction goes through a verification process. This system compares transaction details against an extensive database of over 2.3 billion real-time consumer transactions, identifying potential risks and providing a reliability rating. Instant Account Verification (IAV) transactions will still be processed and verified by MX. This allows your team to approve transactions confidently, knowing that risks such as closed accounts, invalid details, or suspicious account formats are flagged effectively, ensuring compliance and reducing the potential for fraud.

Seamlessly control funding with self-service tools:

Seamlessly control funding with self-service tools:

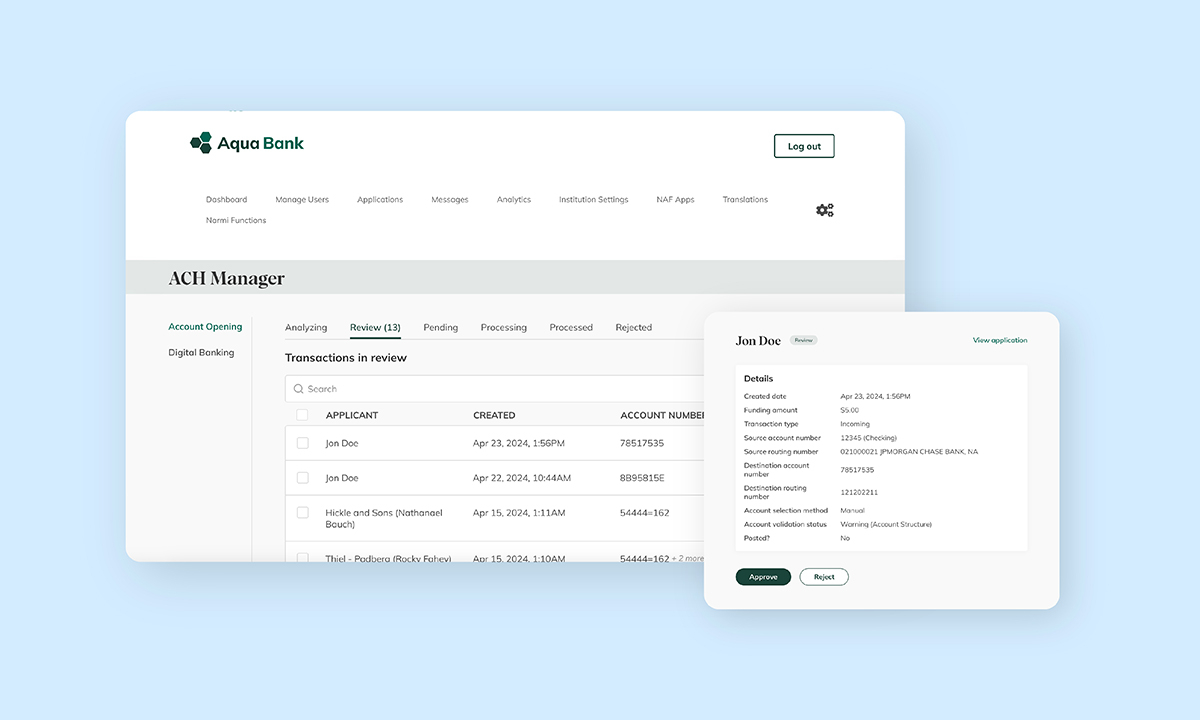

To optimize the management and oversight of AO ACH transactions, we've built a new AO ACH Manager directly in the admin platform. This tool simplifies how staff members manage transactions by categorizing them based on predefined risk criteria. The interface allows staff to quickly identify transactions that require additional review, approve compliant transactions, or reject those flagged for potential fraud. At the end of the day, Narmi will automatically process the NACHA file, and staff members can manually download it, selecting by batch or file type to streamline end-of-day reconciliations. With this beautifully designed interface, FI staff members can effortlessly manage every transaction, intuitively guiding them through the decision-making process with clear and accessible information.

Check out this quick video walkthrough to see the full workflow.

If you are interested in leveraging Narmi's new AO Funding solution at your financial institution, please contact your Narmi representative for more information.