- DATE:

- AUTHOR:

- The Narmi Team

Simplify Developer Integration and Enhance Secure Data Sharing with Narmi's New Public API SDK and Open Banking API

At Narmi, we continuously strive to empower our financial institutions and partners with open, developer-friendly APIs that encourage innovation and maximize platform capabilities. In today’s fast-evolving financial ecosystem, where seamless integration and secure data sharing are critical, we're excited to introduce two pivotal updates: the Public API SDK and the Open Banking API. These enhancements reflect our mission to provide modern, secure, and scalable tools that unlock new opportunities for financial institutions and their partners.

Here’s what to expect:

Simplified API Integration with the Public API SDK

Simplified API Integration with the Public API SDK

The Public API SDK is designed to simplify the process for developers integrating with Narmi's Public API. By focusing on developer experience, the SDK streamlines access and offers starting points to accelerate the time to market for financial institutions and third-party developers alike. Built with TypeScript support, this SDK provides flexibility and ensures a more reliable development process. Narmi has enhanced its documentation and tools to further aid integration, hosting comprehensive setup guides and code generation tools on GitHub. These resources allow developers to move quickly and efficiently through the integration process.

“We're excited to introduce our Public API SDK, designed specifically to give FI and third-party developers the flexibility and ease they need when integrating with our Public API,” said Yaro Melnyk, Group Product Manager at Narmi. “By supporting a growing list of programming languages, we're helping developers speed up their time to market and fully unlock the potential of our platform.”

Secure Data Sharing with the Open Banking API

Secure Data Sharing with the Open Banking API

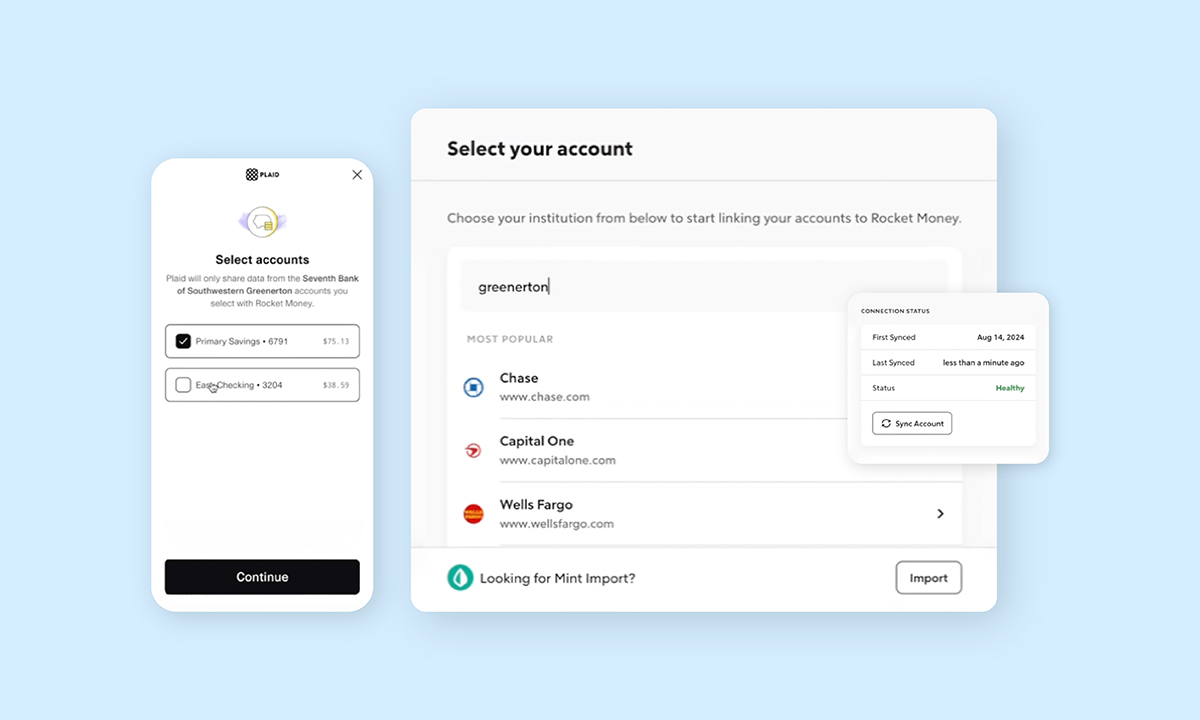

In addition to simplifying API integration, Narmi is introducing the Open Banking API, which is poised to revolutionize how financial institutions securely share customer financial data. This API adheres to the Financial Data Exchange (FDX) standard, enabling institutions to share data with trusted third parties, such as Plaid, MX, and Yodlee, in a secure and standardized way. This will enable members and customers to securely and reliably share their banking information with external fintech apps like Rocket Money, Venmo, Wealthfront, and more, making it easier for them to leverage the Narmi Financial Institutions as their primary banking relationship. Narmi’s Open Banking API leverages modern authorization protocols like OAuth and OpenID Connect (OIDC) to ensure safe, API-based data aggregation. This marks a significant advancement in API-driven data sharing, offering a more secure and efficient alternative to outdated methods used by the broader fintech industry like screen scraping, which is less secure and lacks real-time data updates.

“With the launch of our Open Banking API, we’re making it easier for banking customers and credit union members to share their data in a secure, standardized, and scalable way,” said Martin Lindholm, Director of Product Management at Narmi. “This API will also position financial institutions well for upcoming CFPB regulations around open banking.”

Compliance-Ready for Future Regulations

Compliance-Ready for Future Regulations

Beyond enhancing security, Narmi’s Open Banking API is also compliance-ready, aligning with the Consumer Financial Protection Bureau’s (CFPB) anticipated open banking regulations set to take effect in 2025. By adopting this API, financial institutions can stay ahead of regulatory changes while providing their customers with a modern, secure data-sharing experience.

Together, Narmi’s Public API SDK and Open Banking API empower developers with the tools they need to integrate seamlessly and ensure financial institutions are equipped with secure, scalable solutions for the future of digital banking.

Check out this quick video to learn more about our Open Banking API.