- DATE:

- AUTHOR:

- The Narmi Team

What’s New at Narmi: January Product Highlights

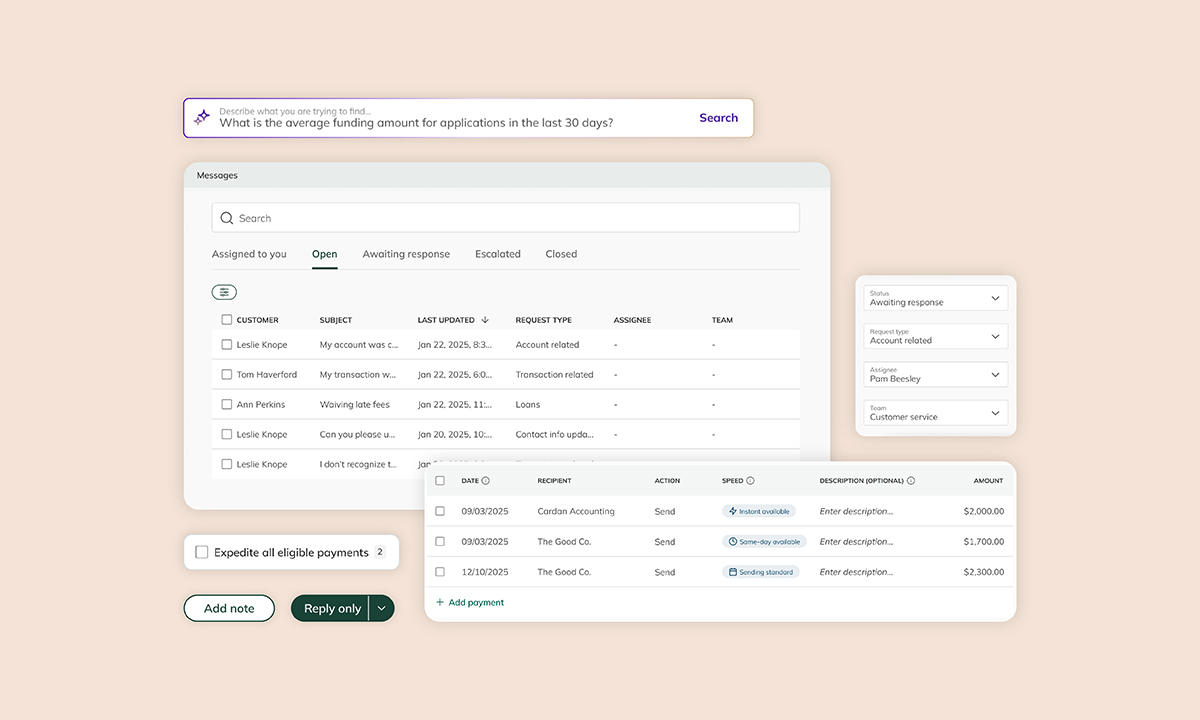

To kick off 2026, Narmi launched new capabilities across payments, operations, and account opening to help community financial institutions accelerate disbursements, streamline internal workflows, and convert more new accounts. From Expedited Bulk Payments that support standard ACH, same-day ACH, and FedNow in a single file to an AI-powered Search Bar that delivers instant answers inside Narmi Command, each release is designed to reduce friction and drive efficiency. A redesigned Secure Messaging Hub centralizes customer context to speed resolution, while seamless account funding with Plaid IAV modernizes onboarding and boosts conversion. Explore the updates below to see how Narmi is helping FIs scale with speed, intelligence, and control.

NEW FEATURES AND UPDATES:

Combine Scale, Speed, and Flexibility with Expedited Bulk Payments

Combine Scale, Speed, and Flexibility with Expedited Bulk Payments

Modernize high-volume disbursements by giving businesses control over both how and how fast money moves. With support for standard ACH, same-day ACH, and instant FedNow in a single bulk file, financial institutions can deliver faster, more flexible payments without adding complexity to meet urgent needs like payroll and time-sensitive bills. By offering speed as a contextual option within existing workflows, this design ensures institutional flexibility regardless of whether an FI is currently live on FedNow.

See product video.

Turn Everyday Admin into Instant Insight with AI Search Bar

Turn Everyday Admin into Instant Insight with AI Search Bar

The new AI Search Bar transforms how staff interact with data in Narmi Command by delivering fast, conversational insights directly within everyday workflows to reduce friction, accelerate decisions, and empower teams to self-serve answers without relying on reports or support tickets. Rather than manually sorting through large tables or navigating between multiple screens, staff can instantly surface metrics and identify relevant records with a simple question.

See product video.

A Redesigned, Secure Messaging Hub to Expedite Workflows and Centralize Customer Insights

A Redesigned, Secure Messaging Hub to Expedite Workflows and Centralize Customer Insights

Narmi’s revamped messaging experience transforms reactive support into a high-performance operational engine, allowing FIs to manage complex customer queries with greater transparency and speed. By bridging the gap between communication and customer data, it empowers staff to deliver personalized, efficient resolutions at scale.

See product video.

Drive Growth and Increase Efficiency with Seamless Account Funding Powered by Plaid IAV

Drive Growth and Increase Efficiency with Seamless Account Funding Powered by Plaid IAV

By integrating Plaid for instant account verification, community banks and credit unions can deliver the seamless, digital-first account opening experience today’s applicants expect, while maintaining flexibility and resilience at the institutional level. Consumers and businesses can fund new accounts in seconds through a simple Plaid interface, eliminating manual entry and reducing friction that often leads to abandonment. For FIs, offering choice between IAV providers not only improves reliability but also reduces operational costs and directly boosts new customer acquisition and revenue.

See product video.

If you have any questions or would like to explore how you can take advantage of these new offerings, please visit help.narmi.com or contact your Narmi representative for a demo.