- DATE:

- AUTHOR:

- The Narmi Team

What’s New at Narmi: June Product Highlights

June has been an exciting and action-packed month for the Narmi team. We launched new features across the Narmi One platform designed to help staff teams save time on customer support, improve the money movement experience for business users, and enhance the ability of community banks and credit unions to attain sticky deposits from new users. Read on to learn more about Narmi AI in Secure Messaging, Enhanced Business ACH functionality, Direct Deposit Switching, and two new Staff-Led Account Types.

NEW FEATURES AND UPDATES:

Draft Support Messages in Seconds - Not Minutes - with Narmi AI

Draft Support Messages in Seconds - Not Minutes - with Narmi AI

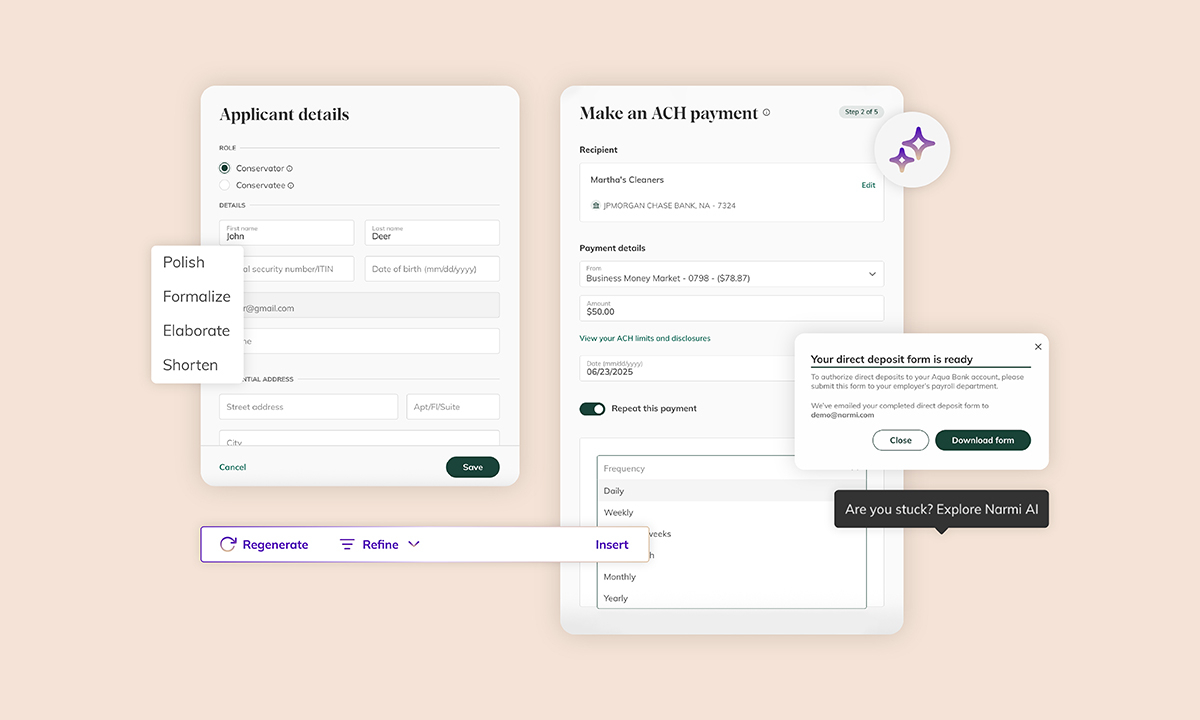

Financial institution staff members face the daily challenge of responding to high volumes of customer messages while maintaining consistent, professional communication. Narmi AI in secure messages streamlines this process by intelligently generating contextual responses and refining message drafts, enabling staff teams to deliver faster, more consistent customer service responses without sacrificing quality.

See product video.

Unlock Sticky, Primary Banking Relationships with Direct Deposit Switching

Unlock Sticky, Primary Banking Relationships with Direct Deposit Switching

Providing a seamless direct deposit switching experience is a critical way to ensure new users make a financial institution their primary bank. With Narmi’s direct deposit switching experience, new users are prompted via onboarding guides to switch their paycheck deposits from their previous bank to their new FI through a flexible flow that supports both automated and manual methods. This helps ensure sticky, stable deposit balances and helps to increase customer lifetime-value for community financial institutions.

See product video.

Enhanced Business ACH Functionality for Secure, Convenient Money Movement

Enhanced Business ACH Functionality for Secure, Convenient Money Movement

Businesses can now schedule ACH payments for a future date and set up recurring payments with flexible frequency options. This helps improve cash flow management and ensures consistent, on-time payments. We’re also introducing dual approvals, which helps businesses ensure there are more internal checks and balances in place before money can be moved out of an account.

See product video.

Support Complex Fiduciary Accounts - Now Fully Built Into Staff-Led Account Opening

Support Complex Fiduciary Accounts - Now Fully Built Into Staff-Led Account Opening

Narmi now enables local branch staff to open Conservatorship and SSA Representative Payee accounts directly within the Staff-Led Account Opening flow. With role-based logic, real-time validation, and required documentation capture, staff teams can confidently support complex fiduciary accounts without manual workarounds or compliance risk.

See product overview below.

If you have any questions or would like to explore how you can take advantage of these new offerings, please visit the developer portal or contact the Narmi team for a demo.