- DATE:

- AUTHOR:

- The Narmi Team

What’s New at Narmi: October Product Highlights

In October, the Narmi team continued to redefine the digital banking experience with innovations that personalize interactions, deepen user engagement, and drive measurable growth. From Quick Actions that tailor everyday banking to each user, to new staff metrics that turn insights into smarter engagement strategies, every enhancement reinforces a more connected and intuitive user journey. In addition, integrated cross-sell loan opportunities and cutting edge AI capabilities powered by Narmi’s MCP Server reveal how personalization and efficiency are at the heart of every release. Check out our updates below to learn more.

NEW FEATURES AND UPDATES:

Personalize Everyday Banking by Bringing the Most-Used Functions Front and Center

Personalize Everyday Banking by Bringing the Most-Used Functions Front and Center

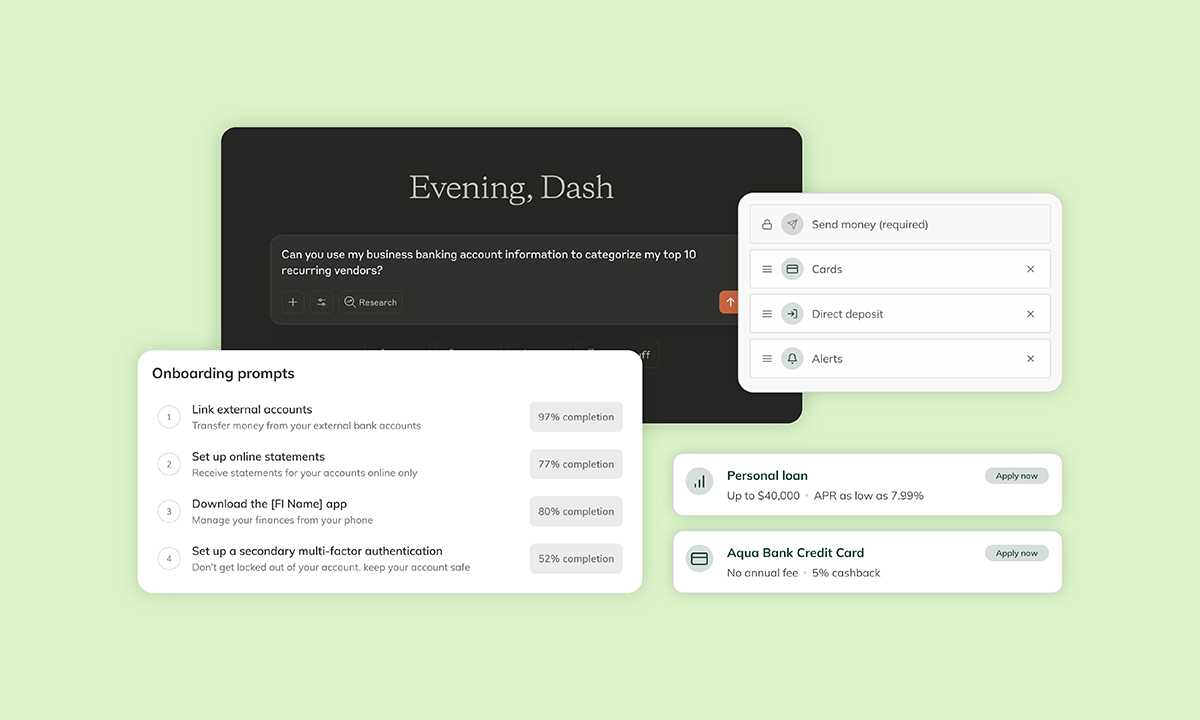

The Quick Actions feature puts the functions that customers use most right at their fingertips. Available on both web and mobile, the customizable shortcut bar allows users to select from a predefined library of actions, reorder their choices, and instantly access up to five shortcuts (with “Send Money” always included). Selections sync seamlessly across platforms, creating a consistent and efficient experience that reduces friction, saves time, and keeps customers engaged.

See product video.

Convert Guesswork into Growth with Guides Staff Metrics

Convert Guesswork into Growth with Guides Staff Metrics

The new Guides Staff Metrics feature gives financial institution staff clear, real-time insights into how each prompt in a Guide performs at driving user action. By understanding completion rates among currently eligible users, institutions can refine and optimize their Guide strategies to maximize retention and accelerate primacy with new digital banking customers.

See product video.

Turn New Account Holders into Multi-Product Customers with Cross-Sell Loan Offers in Account Opening

Turn New Account Holders into Multi-Product Customers with Cross-Sell Loan Offers in Account Opening

Narmi’s cross-sell loan offers enable financial institutions to seamlessly promote lending products at key moments of engagement, driving both originations and customer satisfaction. After completing a new deposit account, customers are instantly shown tailored loan options, such as credit cards or personal loans, configured by the FI. By introducing these offers at an optimal point in the user journey, institutions can streamline cross-sell efforts to maximize conversion.

See product video.

Introducing Narmi’s MCP Server: Drive Financial Management with the Power of AI

Introducing Narmi’s MCP Server: Drive Financial Management with the Power of AI

Narmi has launched the first-of-its-kind Model Context Protocol (MCP) Server, enabling users to access personalized financial insights directly through popular LLMs. Users can securely connect to the MCP using their digital banking credentials and ask questions such as “What kind of computer can I afford?” or “Who are my top recurring vendors?” to receive real-time, AI-generated insights powered by actual transaction data. By pioneering this technology, Narmi is setting a new standard for how consumers can interact with their finances in the age of AI.

See product video.

If you have any questions or would like to explore how you can take advantage of these new offerings, please visit help.narmi.com or contact your Narmi representative for a demo.