- DATE:

- AUTHOR:

- The Narmi Team

What’s New at Narmi: September Product Highlights

In September, Narmi introduced new features designed to help community financial institutions grow deposits and strengthen customer relationships. From AI-powered audience building and frictionless card offers to staff-led tools that streamline onboarding, these enhancements put growth, efficiency, and customer experience at the center of our platform. Check out our updates below to learn more about how we’re innovating at every level.

NEW FEATURES AND UPDATES:

Dynamic Audience Building with AI for Personalized Promotions

Dynamic Audience Building with AI for Personalized Promotions

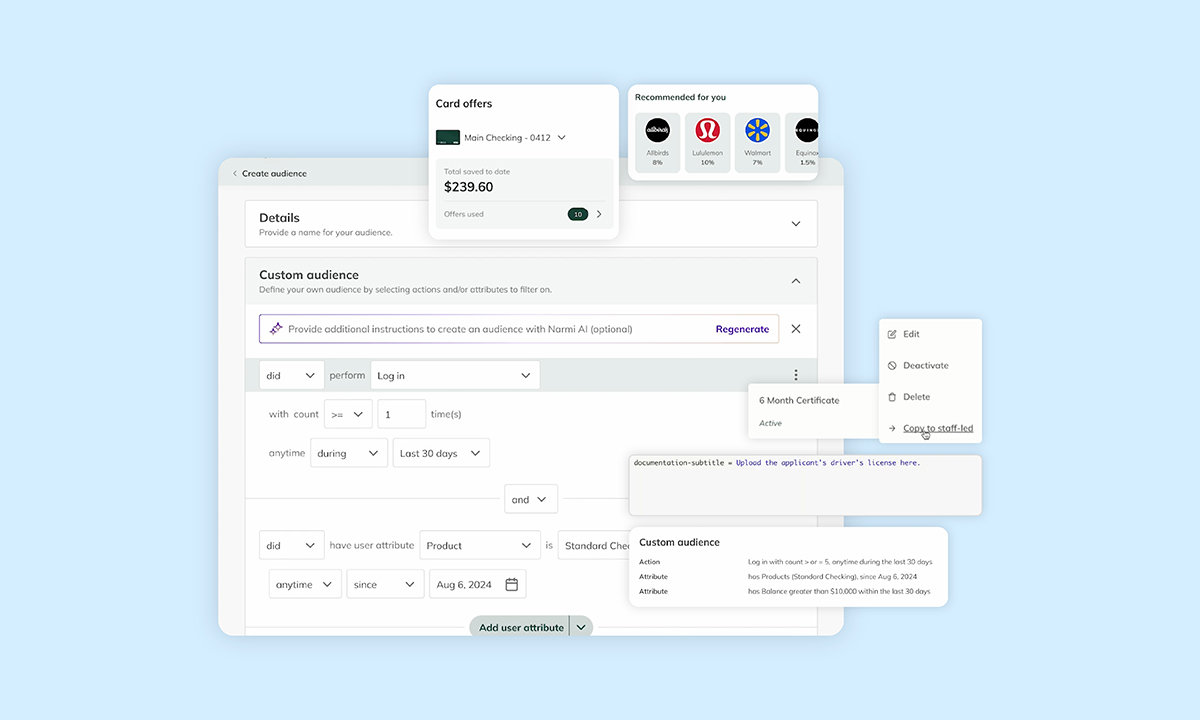

With Audiences, financial institutions can go beyond static segmentation to create flexible, data-driven groups based on real customer behaviors, attributes, and journey milestones. By layering AI into the process, staff members can now build precise audiences in seconds and launch promotions that dynamically update as customer groups evolve – all from seamlessly within the Narmi admin platform.

See product video.

Seamless Card Offers for Top-of-Wallet Growth

Seamless Card Offers for Top-of-Wallet Growth

Narmi’s integrated card offers make it easy for financial institutions to deliver rewards programs without the heavy operational lift. Instead of building costly infrastructure for merchant acquisition, reward design, and reconciliation, customers can now browse and activate offers directly within their banking app, driving engagement and boosting card usage for community FIs to rival mega banks and fintechs.

See product video.

Tailored Product Lists That Put Branch Staff in Control

Tailored Product Lists That Put Branch Staff in Control

Branch staff play a critical role in onboarding, and the new Staff-Led Product List Manager gives financial institutions the ability to configure products specifically for in-branch account openings, separate from online flows. By removing irrelevant fields, enabling duplication from online configurations, and supporting branch-only options like instant-issue debit cards or promotional accounts, this update streamlines staff workflows and ensures applicants see the most relevant products every time.

See product video.

Streamlined Account Opening Workflows with Staff-Led Copy Editor

Streamlined Account Opening Workflows with Staff-Led Copy Editor

With the Staff-Led Copy Editor, institutions can now customize the copy and prompts that staff sees during account opening resulting in clearer, more consistent workflows. From adding instructions for document collection to clarifying eligibility requirements, this flexibility helps financial institutions align processes with compliance standards and operational needs, while giving staff the guidance they need to deliver smoother applicant experiences.

See product video.

If you have any questions or would like to explore how you can take advantage of these new offerings, please visit help.narmi.com or contact your Narmi representative for a demo.