- DATE:

- AUTHOR:

- The Narmi Team

Widen your reach with tailored identity decisioning

Identity decisioning made better

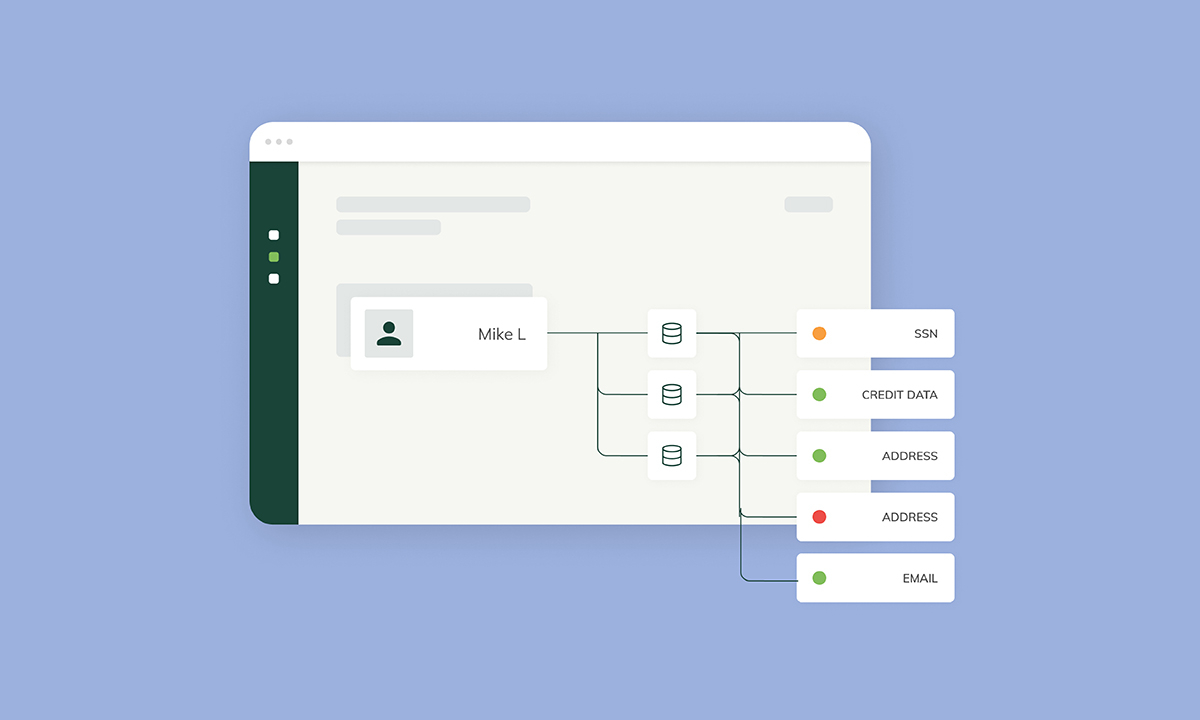

First impressions matter. A fast and easy account opening experience is a critical first step towards building trust and loyalty among account holders. As part of the digital account opening experience with Narmi, applicants can be decisioned in seconds through our best-in-class identity decisioning integration. But not all applicants require the same type of decisioning criteria. How can one tailor the account opening experience to maximize convenience for everyone?

What enhancement did we make to this existing feature?

Prior to this enhancement, all applicants would typically go through the same identity decisioning workflow set by the financial institution and result in getting approved, denied, or sent to manual review. We now give financial institutions the flexibility to tailor how they want to decision a segment of their applicants. For instance, in the case where an FI has multiple brands, they may want to require a driver’s license in the account opening flow for one brand but not have it be a requirement for applicants who come through from another brand. We give them the ability in our admin platform to create alternative identity decisioning workflows per brand which helps them streamline their manual review process and enhance the overall user experience for applicants.

Now financial institutions can do things such as automatically approve all applications, manually review applications that would typically have been denied or give them alternative criteria requirements.

We care about the details of decisioning. Improvements such as these are just one part of many ways we ensure a fast and easy account opening experience for both applicants and the back-office.

Learn more about how this works and how to implement it here.