All Updates

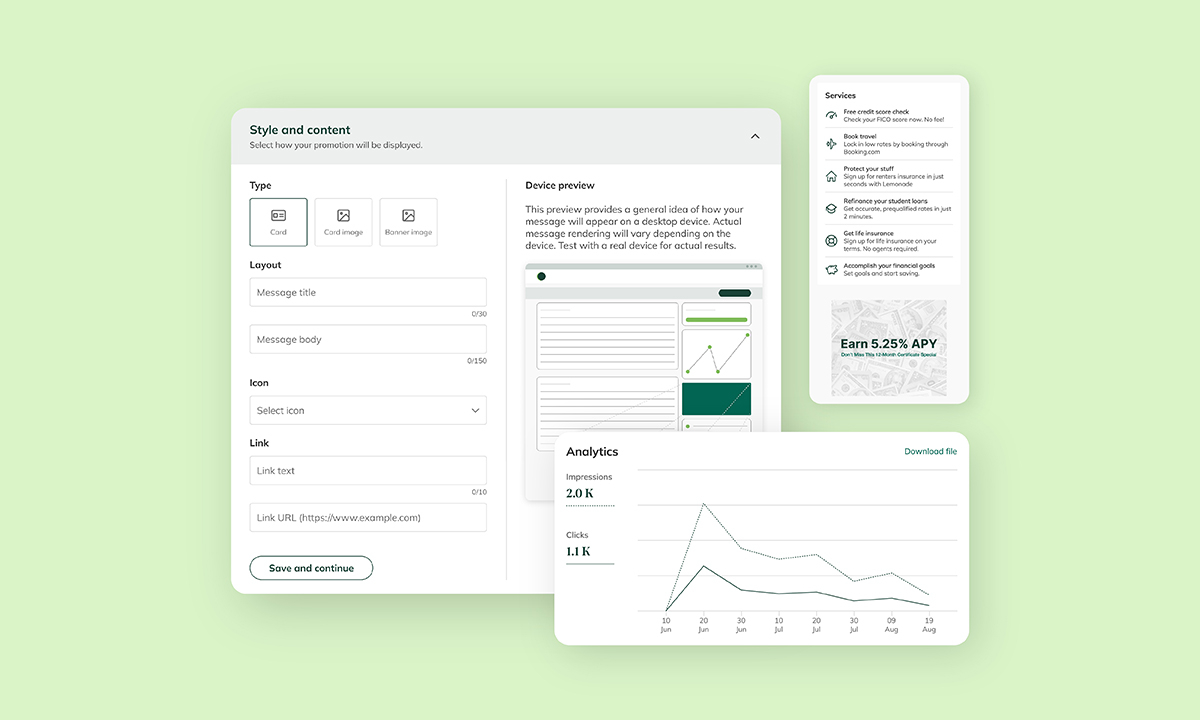

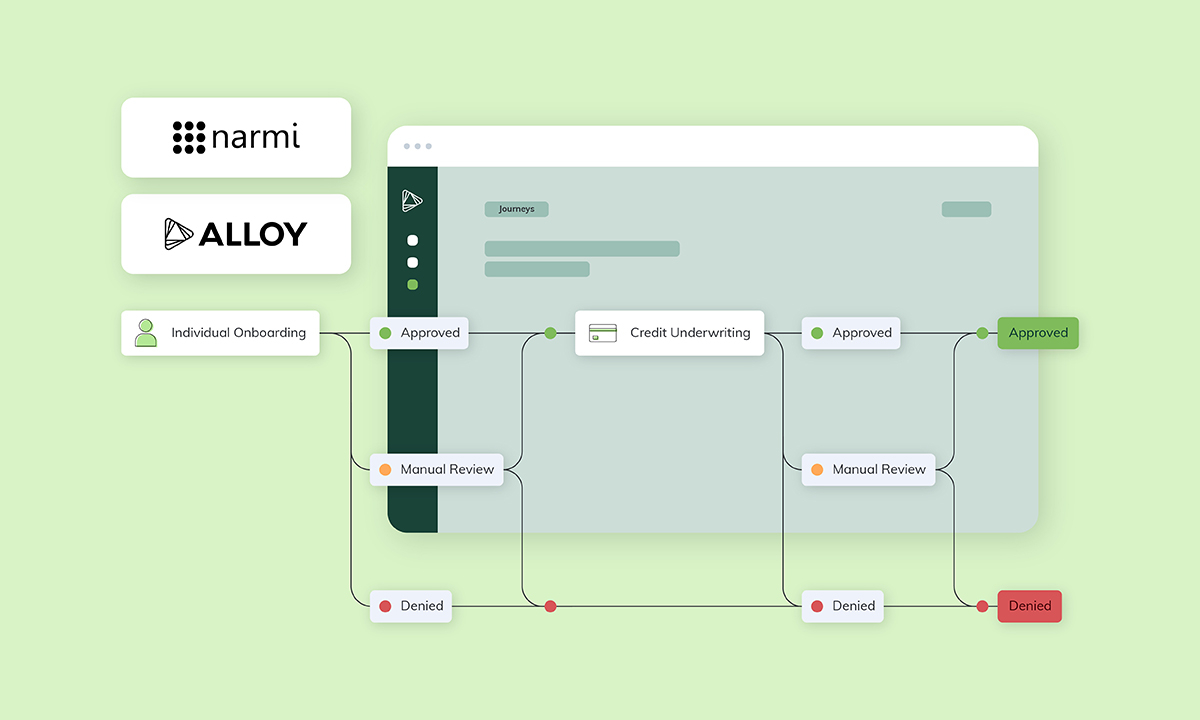

NARMI GROW

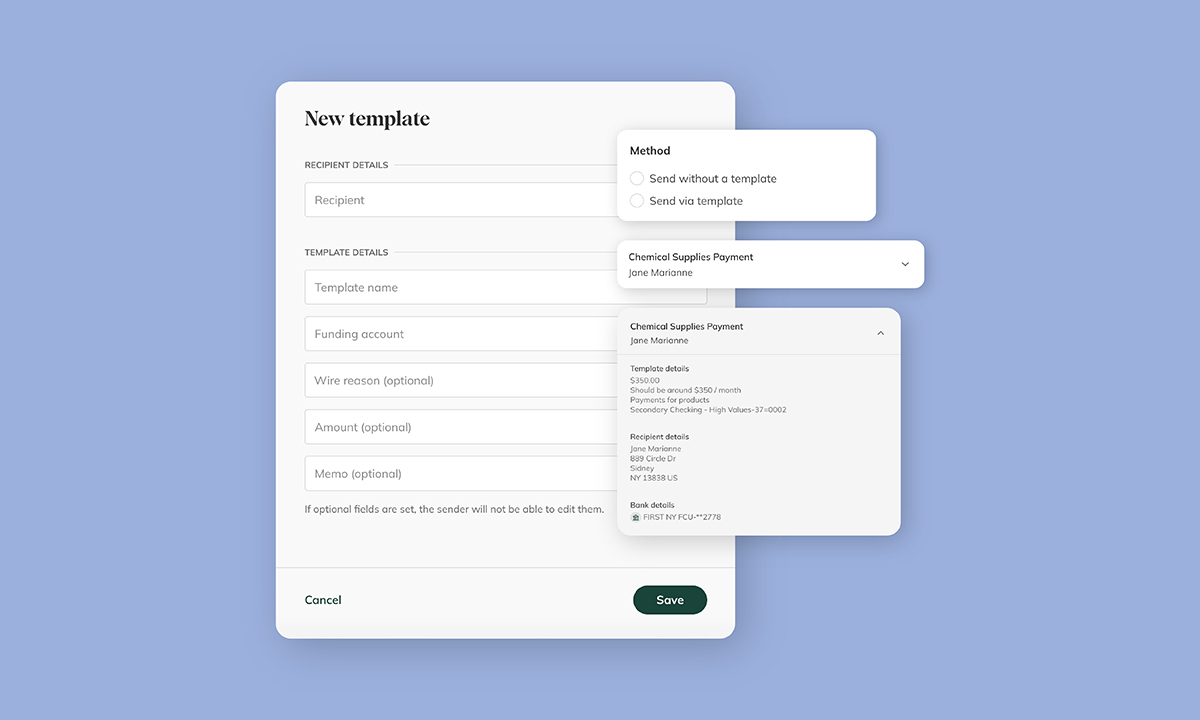

NARMI BANKING

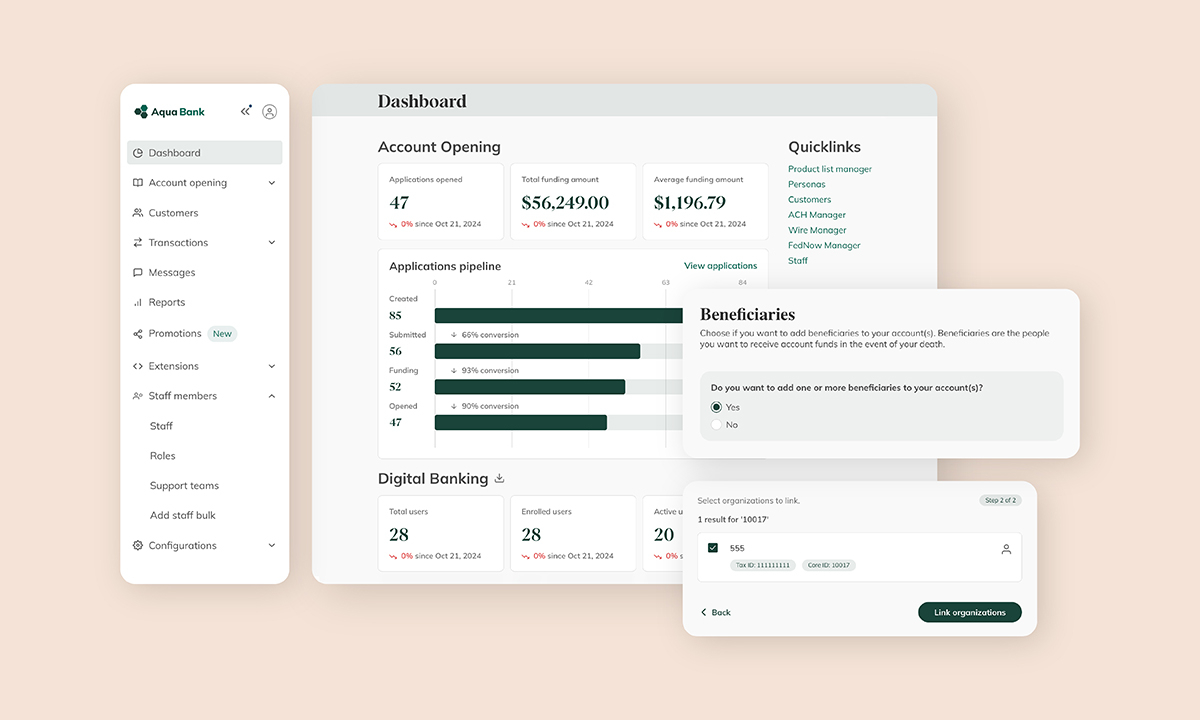

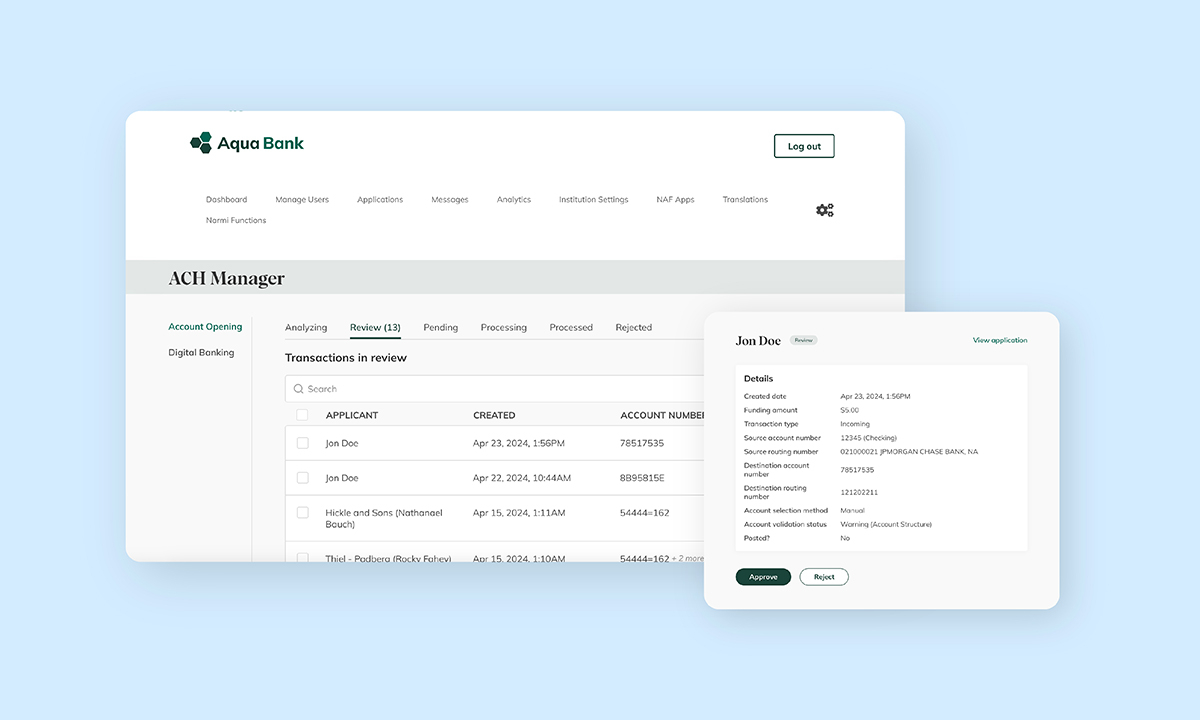

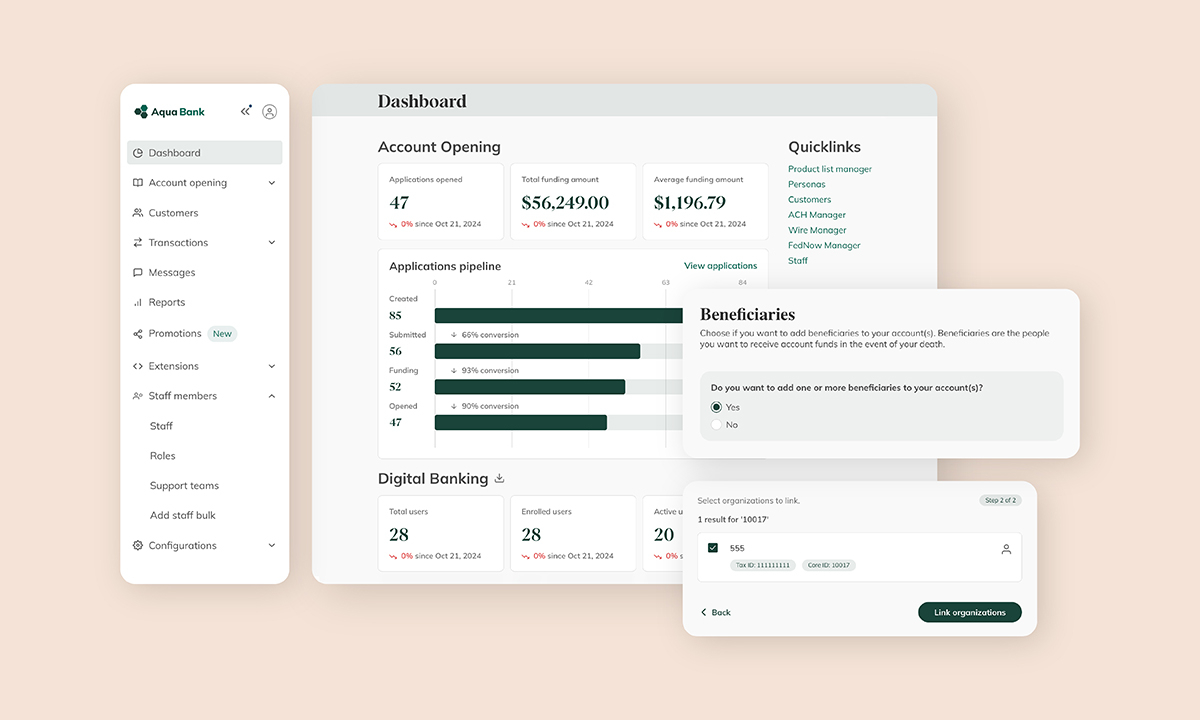

NARMI COMMAND

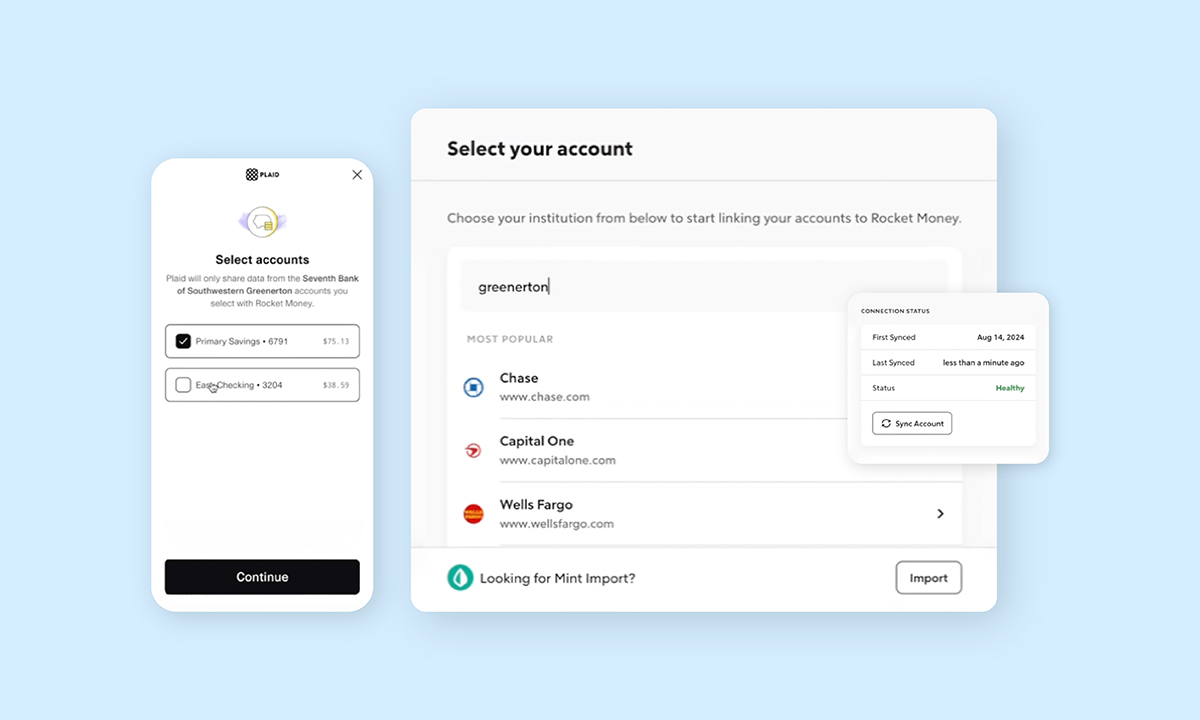

NARMI OPEN

See the latest new features, improvements and product updates from the Narmi team

Loading...

Loading...